Lab-grown diamond manufacturer Adamas One Corp., which will go public on the NASDAQ on December 1, 2022, is expected to offer an IPO priced at $4.50-$5, with an initial offering of up to 7.16 million shares and a maximum of

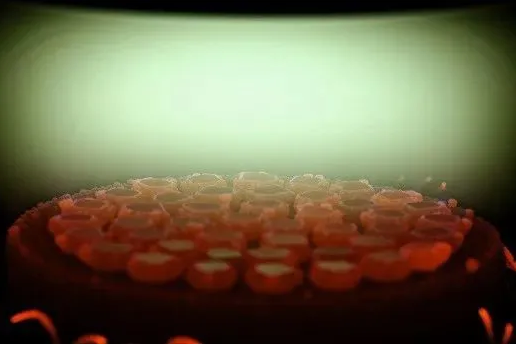

Adamas One uses its unique technology to produce high-quality single crystal diamond and diamond materials through the CVD process, mainly for lab-grown diamonds in the jewelry sector and raw diamond materials for industrial use. The company is currently in the initial stages of diamond commercialization and its main mission is to develop a sustainable and profitable business model.

Adamas One acquired Scio Diamond in 2019 for $2.1 million. Scio Diamond was formerly known as Apollo Diamond. Apollo’s origins can be traced back to 1990, when it was considered one of the first companies in the gem-quality lab-grown diamond field.

According to the documents, Scio was unable to continue operating due to financial constraints. Believing that it can make this transition, Adamas One has begun manufacturing diamonds for the high-end jewelry market and working to make colored lab-grown diamonds. Adamas One said it has leased a facility that it expects to house up to 300 CVD-grown diamond equipment.

According to the listing documents, as of March 31, 2022, Adamas One has just commenced commercial sales of lab-grown diamond products, and there are currently limited products available for commercial use, and few lab-grown diamonds or diamond materials are available for sale to consumers or commercial buyers. However, Adamas One said it will strive to improve the quality and scale of its products for lab-grown diamonds and diamonds, and seek related business opportunities. In terms of financial data, Adamas One had no revenue data in 2021 and a net loss of $8.44 million; Revenue for 2022 was $1.1 million and net loss was $6.95 million.

Post time: Dec-02-2022